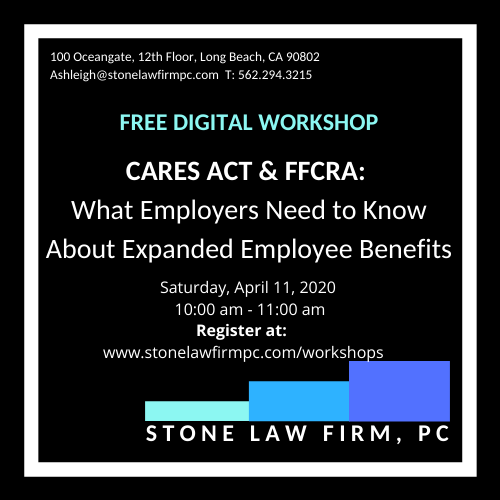

CARES ACT & FFCRA: What Employers Need to Know About Expanded Employee Benefits

Free Digital Workshop - Register via Link Below

The Coronavirus Act, Relief and Economic Security (CARES) Act and Families First Coronavirus Response Act (FFCRA) expand many employee benefits. This second round digital workshop will give an overview of the changes imposed on California employers to ensure your HR practices are up to date with these changing times.

Overview Includes:

FFCRA

Expanded Family & Medical Leave

Expanded Paid Sick Leave

Tax Credit

CARES Act

Expanded Unemployment Benefits

Business Tax Benefits

Employer assistance with student loan debt

Need expert Human Resources guidance? Learn more about our HR at Hand advice and counsel services HERE. Schedule a free call to discuss your current needs HERE.